GDP Measured by Components of Demand

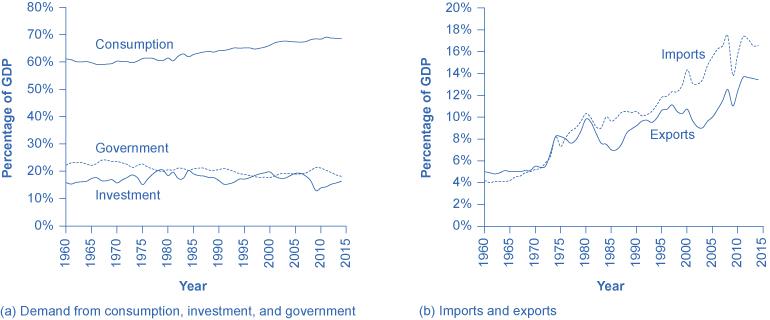

Who buys all of this production? This demand can be divided into four main parts: consumer spending (consumption), business spending (investment), government spending on goods and services, and spending on net exports. (See the following Clear It Up feature to understand what is meant by investment.) Table 5.1 shows how these four components added up to the GDP in 2014. Figure 5.4 (a) shows the levels of consumption, investment, and government purchases over time, expressed as a percentage of GDP, while Figure 5.4 (b) shows the levels of exports and imports as a percentage of GDP over time. A few patterns running through each of these components are worth noticing. Table 5.1 shows the components of GDP from the demand side. Figure 5.3 provides a visual of the percentages.

|

Components of GDP on the Demand Side (in Trillions of Dollars) |

Percentage of Total |

| Consumption |

$11.9 |

68.4% |

| Investment |

$2.9 |

16.7% |

| Government |

$3.2 |

18.4% |

| Exports |

$2.3 |

13.2% |

| Imports |

–$2.9 |

–16.7% |

| Total GDP |

$17.4 |

100% |

Table 5.1 Components of U.S. GDP in 2014: On the Demand Side (Source: http://bea.gov/iTable/index_nipa.cfm)

Clear It Up

What is meant by the word investment?

What do economists mean by investment, or business spending? In calculating GDP, investment does not refer to the purchase of stocks and bonds or the trading of financial assets. It refers to the purchase of new capital goods; that is, new commercial real estate (such as buildings, factories, and stores) and equipment, residential housing construction, and inventories. Inventories that are produced this year are included in this year’s GDP—even if they have not yet sold. From the accountant’s perspective, it is as if the firm invested in its own inventories. Business investment in 2014 was almost $3 trillion according to the Bureau of Economic Analysis (BEA) (2013).

Consumption expenditure by households is the largest component of GDP, accounting for about two-thirds of the GDP in any year. This tells us that consumers’ spending decisions are a major driver of the economy. However, consumer spending is a gentle elephant: When viewed over time, it does not jump around too much.

Investment expenditure refers to purchases of physical plants and equipment; primarily by businesses. If a chain of coffee shops builds a new store, or a delivery service buys robots, these expenditures are counted under business investment. Investment demand is far smaller than consumption demand, typically accounting for only about 15–18 percent of GDP, but it is very important for the economy because this is where jobs are created. However, it fluctuates more noticeably than consumption. Business investment is volatile: New technology or a new product can spur business investment, but then confidence can drop and business investment can pull back sharply.

If you have noticed any of the infrastructure projects (new bridges, highways, airports) launched during the recession of 2009, you have seen how important government spending can be for the economy. Government expenditure in the United States is about 20 percent of GDP and includes spending by all three levels of government: federal, state, and local. The only part of government spending counted in demand is government purchases of goods or services produced in the economy. Examples include the government buying a new fighter jet for the Air Force (federal government spending), building a new highway (state government spending), or setting up a new school (local government spending). A significant portion of government budgets are transfer payments, like unemployment benefits, veteran's benefits, and Social Security payments to retirees. These payments are excluded from GDP because the government does not receive a new good or service in return or exchange. Instead, they are transfers of income from taxpayers to others. If you are curious about the awesome undertaking of adding up GDP, read the following Clear It Up feature.

Clear It Up

How do statisticians measure GDP?

Government economists at the BEA, within the U.S. Department of Commerce, piece together estimates of GDP from a variety of sources.

Once every five years, in the second and seventh year of each decade, the Census Bureau carries out a detailed census of businesses throughout the United States. In between, it carries out a monthly survey of retail sales. These figures are adjusted with foreign trade data to account for exports that are produced in the United States and sold abroad and for imports that are produced abroad and sold here. Once every 10 years, the Census Bureau conducts a comprehensive survey of housing and residential finance. Together, these sources provide the main basis for figuring out what is produced for consumers.

For investment, the Census Bureau carries out a monthly survey of construction and an annual survey of expenditures on physical capital equipment.

For what is purchased by the federal government, the statisticians rely on the U.S. Department of the Treasury. An annual Census of Governments gathers information on state and local governments. Because a lot of government spending at all levels involves hiring people to provide services, a large portion of government spending is also tracked through payroll records collected by state governments and by the Social Security Administration.

With regard to foreign trade, the Census Bureau compiles a monthly record of all import and export documents. Additional surveys cover transportation and travel, and adjustment is made for financial services that are produced in the United States for foreign customers.

Many other sources contribute to the estimates of GDP. Information on energy comes from the U.S. Department of Transportation and Department of Energy. Information on healthcare is collected by the Agency for Healthcare Research and Quality. Surveys of landlords find out about rental income. The Department of Agriculture collects statistics on farming.

All of these bits and pieces of information arrive in different forms, at different time intervals. The BEA melds them to produce estimates of GDP on a quarterly basis (every three months). These numbers are then annualized by multiplying by four. As more information comes in, these estimates are updated and revised. The advance estimate of GDP for a certain quarter is released one month after a quarter. The preliminary estimate comes out one month after that. The final estimate is published one month later, but it is not actually final. In July, roughly updated estimates for the previous calendar year are released. Then, once every five years, after the results of the latest detailed five-year business census have been processed, the BEA revises all of the past estimates of GDP according to the newest methods and data, going all the way back to 1929.

Link It Up

Visit this website to read FAQs on the BEA site. You can even email your own questions!

When thinking about the demand for domestically produced goods in a global economy, it is important to count spending on exports—domestically produced goods that are sold abroad. By the same token, we must also subtract spending on imports—goods produced in other countries that are purchased by residents of this country. The net export component of GDP is equal to the dollar value of exports (X) minus the dollar value of imports (M): (X – M). The gap between exports and imports is called the trade balance. If a country’s exports are larger than its imports, then a country is said to have a trade surplus. In the United States, exports typically exceeded imports in the 1960s and 1970s, as shown in Figure 5.4 (b).

Since the early 1980s, imports have typically exceeded exports, and so the United States has experienced a trade deficit in most years. Indeed, the trade deficit grew quite large in the late 1990s and in the mid-2000s. Figure 5.4 (b) also shows that imports and exports have both risen substantially in recent decades, even after the declines during the Great Recession between 2008 and 2009. As noted before, if exports and imports are equal, foreign trade has no effect on total GDP. However, even if exports and imports are balanced overall, foreign trade might still have powerful effects on particular industries and workers by causing nations to shift workers and physical capital investment toward one industry rather than another.

Based on these four components of demand, GDP can be measured as

Understanding how to measure GDP is important for analyzing connections in the macroeconomy and for thinking about macroeconomic policy tools.