Learning Objectives

By the end of this section, you will be able to do the following:- Identify the demanders and suppliers in a financial market

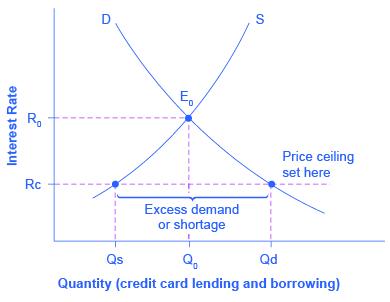

- Explain how interest rates can affect supply and demand

- Analyze the economic effects of U.S. debt in terms of domestic financial markets

- Explain the role of price ceilings and usury laws in the United States

U.S. households, institutions, and domestic businesses in the United States saved almost $1.9 trillion in 2013. Where did that savings go, and what was it used for? Some of the savings ended up in banks, which in turn loaned the money to individuals or businesses that wanted to borrow money. Some was invested in private companies or loaned to government agencies that wanted to borrow money to raise funds for purposes like building roads or mass transit. Some firms reinvested their savings in their own businesses.

In this section, we will determine how the demand and supply model links those who wish to supply financial capital (i.e., savings) with those who demand financial capital (i.e., borrowing). Those who save money (or make financial investments, which is the same thing), whether individuals or businesses, are on the supply side of the financial market. Those who borrow money are on the demand side of the financial market.